Back in May 2022, I made a bet Australian house prices would decline relative to Belgian ones, and the Australian cash rate wouldn't grow as high as the Euro-zone one. On that day, the RBA had lifted the Australian cash rate from the historical low of 0.10% to 0.35%. Today, that rate stands at 4.10%, with the latest increase in a series of 12 having happened at the start of June 2023 - an increase of 4%pt.

The European central bank in the mean time has raised its main refinancing operations rate 9 times since July 2022 from 0% to 4.25% at the start of August 2023, an increase of 4.25%pt.

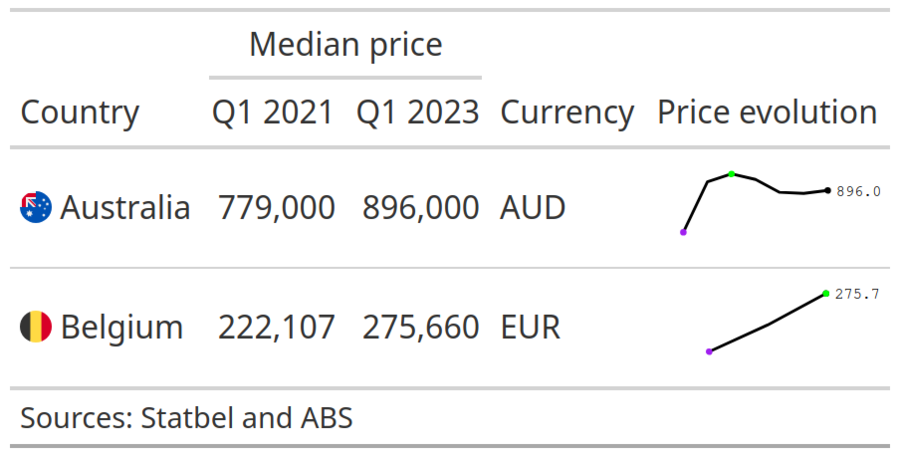

Both the Australian and the Belgian government have statistical offices publishing median house prices. The way these are tracked varies slightly between the countries. In Belgium, Statbel publishes median prices for 3 types of residential dwellings every quarter, and the corresponding number of transactions that happened for each of these. The Australian Bureau of Statistics on the other hand publishes a median residential dwelling price every month, which is based on a stratification by dwellings type taken from the census which happens every 4 years.

Figure 1: Table with evolution of house prices

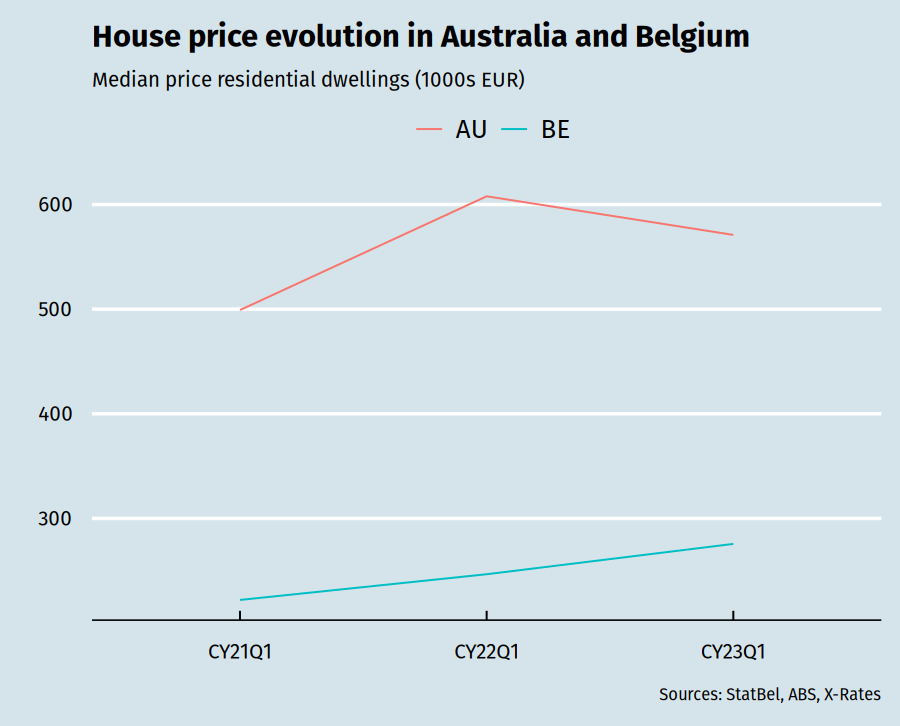

Of course, the AUD/EUR exchange rate needs to be taken into account as well. I've adjusted the prices using the weighted average monthly exchange rate. This way, we can compare the price evolution in a way that takes into account the evolving difference in purchasing power between the currencies of the 2 nations.

Figure 2: Plot with evolution of house prices in EUR

Comparing the first 3 months of 2021 to the first 3 months of 2023, the relative price of an Australian residential dwelling has gone to 92% of what it was when compared to its Belgian equivalent. If the starting point is Q1 2022, just before the rates started going up, the difference is an even starker 16% relative decline in price!

So far, both bets seem to have been correct - house prices in Australia have significantly gone down relative to the Belgian ones since the interest rate hikes started, and the cash rate in Europe, which started slightly lower than the one in Australia, has already surpassed it.

Posted on Saturday 2 September 2023 at 16:01