Using Markov chains' transition matrices to model the movement of loans from being opened (in a state of "Current") to getting closed can misinform the user at times.

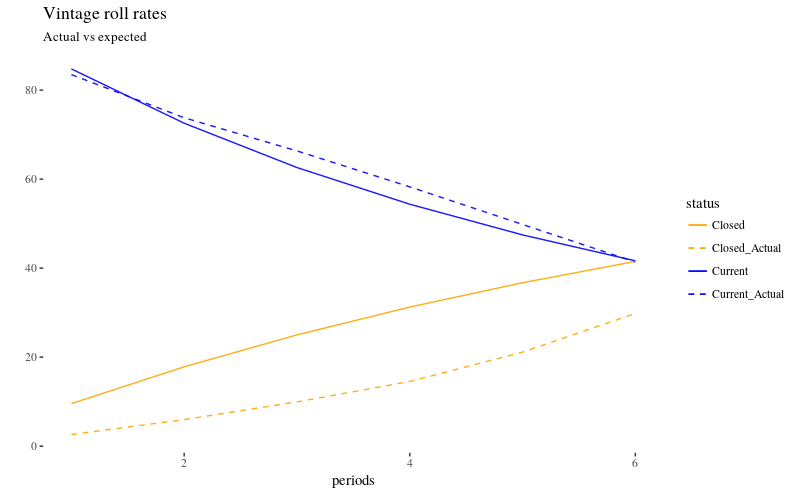

To illustrate the challenge, the graph below plots the evolution, from the original state to the final state, of a group of loans over 6 periods of time.

Figure 1: Actual vs predicted loan vintage performance.

The solid lines are the result of applying an average transition matrix 6 times (the model's predicted outcome). The dashed lines are the actual observed results for a set of loans.

As can be seen, the model does not do a very good job at predicting the accounts that will end up in state "Closed" in each period. They end up in a different state between Current and Closed (i.e. overdue) at a higher than expected rate. Why is that?

The prediction was built using an average of the transition matrix of a number of consecutive period statetables for a book of loans. That book was not homogenic though. Most obviously, the "Current" accounts were not of the same vintage - some had been in that state for a number of periods before already. The observed set of loans all originated in the same period. Other differences can be related to client demographics, loan characteristics or macro-economic circumstances.

Applying a transition matrix based on a group of loans of various vintages to a group of loans that all were new entrants in the book violates the often implied Markov chain assumption of time-homogenity.

What that assumption says is that the future state is independent of the past state.

Loans typically have a varying chance of becoming delinquent in function of how long they have been open already.

Multi-order Markov chains are those that depend on a number (the order) of states in the past. The question becomes - what order is the Markov chain? Otherwise put, how many previous periods need to be taken into account to be able to accurately estimate the next period's statetable? Controlling for the other differences suggested above, if found to be material, may be important as well.

Posted on Friday 17 February 2017 at 20:07